I love a good chart. This one hits hard. It is quietly confronting.

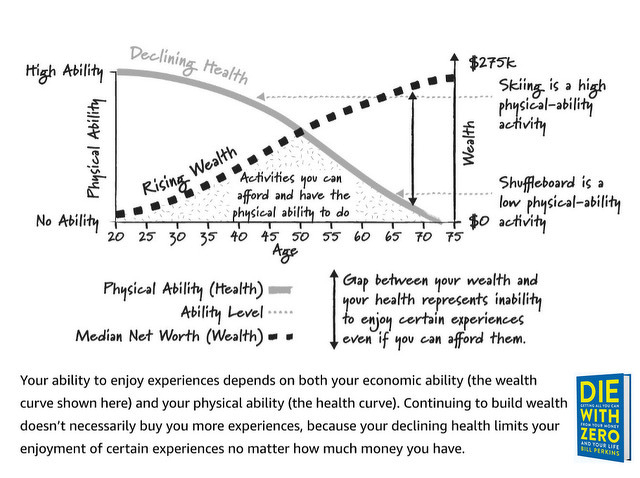

Two lines. One tracks wealth, rising steadily with age as savings accumulate. The other tracks physical ability, declining just as steadily as the body slows down. The space between them widens year by year. That space, according to Die with Zero, is where missed experiences pile up. Things you can finally afford but can no longer fully enjoy.

Bill Perkins, the book’s author, calls this the gap between your wealth and your health. He is a hedge fund manager, energy trader, and professional poker player. Someone who understands compounding intimately, which is why this is not an anti-wealth book. It is an anti-waste one.

The chart gives concrete examples. Skiing sits high on the physical-ability axis. It requires strength, stamina, and joints that recover quickly, best enjoyed earlier in life. Lawn bowls sits low, accessible much later, when the body has become less forgiving. You can eventually afford both. But only one of them waits for you.

Perkins reframes personal finance as a life-planning problem. Spend earlier where it expands what you can do. Invest in what he calls “memory dividends”: experiences that keep paying returns in recollection long after the moment itself has passed. Stop assuming your future self will be better equipped to enjoy the things your present self keeps deferring.

This is not permission to be careless. Perkins is explicit about maintaining baseline security. But his argument is pointed. Most people err in the other direction. They optimise for a number on a screen, funding a future their declining bodies can no longer fully inhabit.

It is a balancing act, of course: investing in experiences versus having enough to live on for decades to come. But the Aussie caravanners have it right. Adventure before dementia. We all know someone who never got to do the big lap.